Student mobility & payments innovation in a digital economy – United States

This article is part of a series of topical blogs exploring key insights from our Fintech2025+ report, which is available to download now.

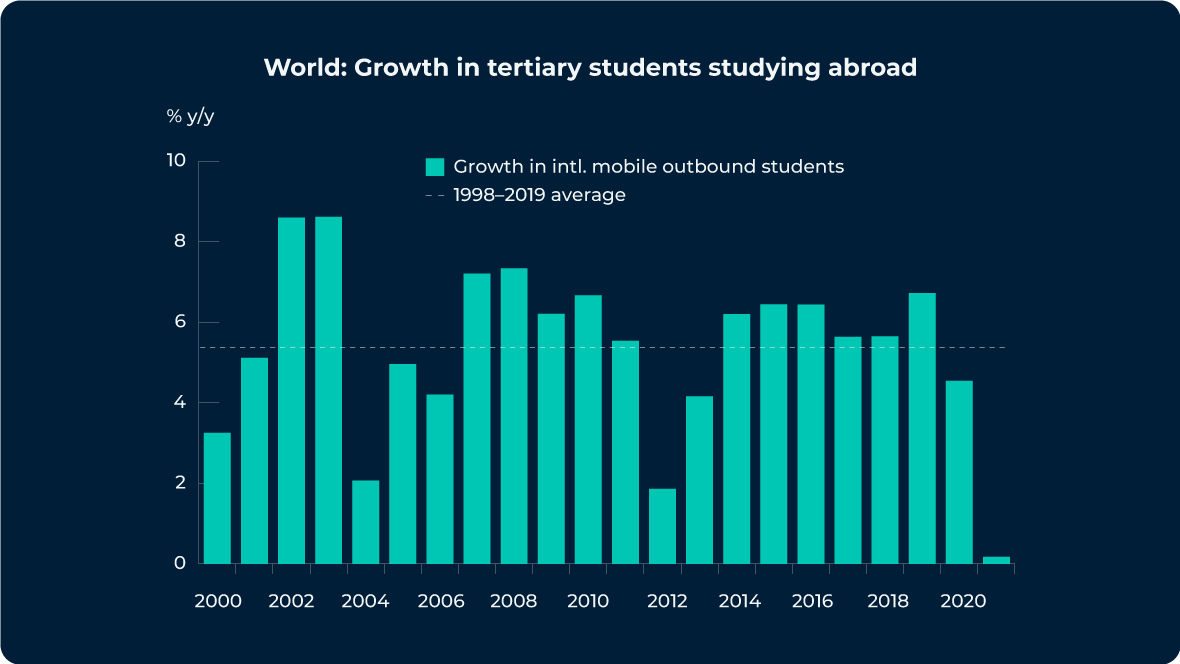

The digital economy is transforming the landscape of student mobility and international payments. Since 1998, the number of international students has more than tripled, and despite recent economic challenges, projections indicate robust growth in student mobility and associated cross-border payments. This presents opportunities and challenges for education institutions, who are facing the expectations of students familiar with fintech innovations such as real-time payments, digital wallets, and central bank digital currencies.

Long-term growth in international students

In 1998, when UNESCO records began, there were just under two million international students enrolled globally. By 2020, this number had more than tripled to 6.4 million driven by an increasingly globalized world economy and access to financial aid for international students.

Growth in outbound students has now exceeded global (real) GDP growth. However, when viewed through an alternative GDP measure weighted by outbound students, there is a strikingly close correlation between the two. This indicates that when analyzed through a more nuanced lens, macroeconomic conditions in sending countries have been very strongly correlated with international student volumes at the global level since UNESCO records began.

That said, the economic shocks of the past few years have had an impact. The world’s largest outbound student markets faced a considerable slowdown in real household disposable income growth in the 2021–23 period compared to the average rate of growth over the last two decades. This implies a recent slowdown in outbound students most pronounced in China, South Korea, the US and Nigeria, and less severe in other major outbound markets such as India and Vietnam.

Continued robust growth expected in international students

Despite this dampening of growth in certain outbound countries, the Fintech 2025+ report suggests that in the period to 2030 global outbound student volumes will grow at an average rate of 4 – 4.5% per year.

China and India are expected to remain the leading senders of international students. Although other countries may experience stronger economic and demographic growth, the sheer scale of China and India means their slower growth rates will still result in significantly higher student mobility volumes.

Meanwhile, student mobility in Brazil and Pakistan is expected to exceed historical growth rates despite facing various macroeconomic challenges. Although overshadowed by the likes of India and China, Brazil is a sturdy source of international students contributing approximately 90,000 individuals to the market.

In 2023, over 1 million Chinese students were studying abroad, while the number of international students from India totaled over 516,000, a figure expected to increase based on the country’s rapidly growing middle class.

Student mobility and cross border payments growth

According to Oxford Economics’ research for the Fintech 2025+ report, total cross border payment flows are expected to reach $290 trillion by 2030. Given robust (albeit moderating) growth in the international student market, it’s expected that education-related cross-border payments should also continue to grow at a solid pace.

Initiatives are being developed by the G20 to enhance cross-border payments, by addressing issues like high costs and low speed.

Growth in cross-border payments will vary by region, with prospects brightest for payment corridors in Asia-Pacific, which is forecast to be the fastest-growing region. This reflects the region’s rapid economic growth, and advances in infrastructure and payments technologies facilitated by collaboration between regional governments.

Five of the top ten outbound student markets are situated in Asia Pacific, suggesting that student mobility has a role to play in the growth of cross border payments in the region. Asia Pacific is also leading the way in payments innovation, showing significant adoption of real time payments, digital wallets, and advancements in blockchain technology such as central bank digital currencies (CBDC).

The region’s progressive stance on the digital economy means that education institutions must be prepared to meet the advanced payment needs of international students from top outbound markets such as China and India.

Central bank digital currencies (CBDCs), and China’s alternative payments ecosystem

Cash is on the outer in China, with US$434 trillion transacted electronically every year according to UnionPay, and over 80% of daily consumption transactions done via mobile platforms.

China relies on an alternative payment system built on digital wallets running through Alipay and WeChat Pay. Together these two companies own over 90% of the country’s digital payment market, creating an ecosystem that bypasses intermediary banks and financial institutions, and creates different incentives between merchants, consumers, and payment system providers.

Fuelled by integration with digital wallets, China is also among the top five real time payment (RTP) markets, estimated at USD 5.46 billion. To enhance RTPs and advocate for the internationalization of the yuan, China has built a cross border interbank payment system (CIPS). This also functions as an alternative payment system that allows countries to bypass the dollar-denominated SWIFT…

Read More: Student mobility & payments innovation in a digital economy – United States

2024-07-24 01:42:30