Juan Triana: “The instability in the exchange rate stops business and affects

At the end of December 2023, we published a conversation with the economist, professor, and OnCuba columnist, Juan Triana Cordoví, in which he took stock of the year about to end and made a definitive prediction about what awaited us: “2024 is going to be really tough.” And so it has been.

During that interview, which already has nearly 40,000 views, we agreed to meet again to talk by video call about current Cuban economic events.

In these six months we have had blackouts, protests, a small rebound in tourism, more than 11,000 MSMEs approved; a former minister of economy “rigorously investigated” for “serious errors” — which have not yet been explained — “in the performance of his duties,” and a new minister whose name few know, due to lack of press coverage.

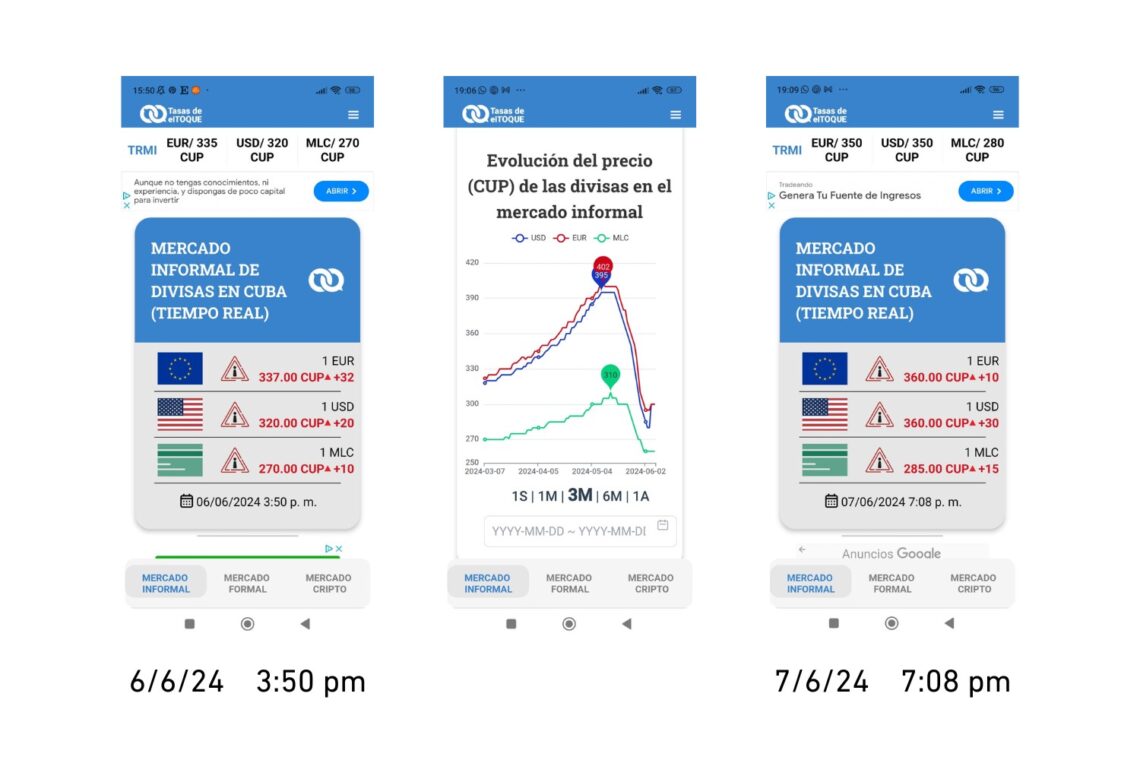

Among all this, what has perhaps sparked the most attention and multiple debates in recent weeks has been the movement of the exchange rate between the dollar and the Cuban peso, which after reaching the peak of 400 pesos per dollar, then plunged to 280 in a few days, to resume climbing again, according to El Toque.

While we were talking, yesterday, June 6, the dollar was at 320 pesos, according to that record of the informal market in real-time. A little more than 24 hours later it already reached 360. How much will it be next Sunday? Presumably, it will skyrocket again. How far could it go and why is it something we all ask, sometimes trying to emulate fortune tellers?

The issue has been so controversial that El Toque published its decision to “strengthen controls to calculate the representative rate of the informal currency market.”

What happened? What are these telluric movements of currencies about that make people try to explain the causes, the reasons, the results, the consequences? What is your vision of the matter?

What happened? What are these telluric movements of currencies about that make people try to explain the causes, the reasons, the results, the consequences? What is your vision of the matter?

I would start by telling you that in these six months, there are also specific improvements in tourism, which is very good. There are improvements to some export issues; as well as a prospect of improving the price of nickel. But there really are no improvements of the magnitude that would allow the Cuban family to reach those improvements.

What has happened to the exchange rate is due to several factors.

The first thing to say is that there has not been any significant change in the causes that have motivated a rise and galloping inflation and that upward volatility of the exchange rate in recent months, the objective factors that influence the exchange rate…

We continue having a significant deficit and that generates liquidity, which is one of the causes of the increase in the exchange rate, because it increases liquidity without material support.

We have not had a significant reaction from the Cuban productive system. Especially in the agricultural sector, which I would say is the one that is, unfortunately, leading the increase in prices, up to 60, 60-odd percent. There is no substantial increase in supply and, therefore, if supply does not grow and production does not grow, it is another of the objective causes that can generate inflation.

Well, obviously the exchange rate is not going to be reduced. And on top of that, we have people’s expectations.

All of this acts as an ajiaco, that is, a mixture of objective causes along with expectations.

What people’s expectations do is anticipate the rate. That is, if there is an upward trend in the rate and I am going to sell or buy dollars or sell or buy products, what I do is anticipate the rate. It’s the Ockham law in the end. In other words, since I’m thinking that the rate is going to go up, the rate goes up. And since I’m thinking that the rate is going to go up, I advance the rate. Instead of the exchange rate, for example, that El Toque estimates, I estimate the exchange rate of El Toque plus 10 pesos. And when many people do that in a row, logically the rate shifts.

Or 10 pesos less.

Yes, it can influence both upwards and downwards. What other factor do I think has had a huge impact there? The fact that there is a gap in regulatory terms. There is no intervention instrument like there was before, which was the Cadeca exchange offices, which could intervene in the money market and could somehow regulate the rate. The great success of Cuban monetary policy for a long time was having maintained the stability of the exchange rate between the Cuban peso and the dollar and later between the Cuban peso and the CUC.

That was achieved for a long time, almost from 1996 to 2019. The exchange rate was stable and that is very good, and it is very good for business.

The instability of the exchange rate, especially an exchange rate that is so volatile upwards, ultimately causes business to stop.

The other factor that somewhat influenced the drop in the exchange rate, in addition to speculation, was the fact that importers, especially private-sector importers, refrained from importing the same quantities as last year. Because? Because of the uncertainty.

If you import at an exchange rate of 370 pesos per dollar, and when your merchandise arrives at the port a month later or 20 days later, the exchange rate is 390, you are already losing 20 Cuban pesos for every dollar of imports.

You mentioned it and I have been seeing how most economists agree that the exchange market is racing. Pedro Monreal, for example, just published today in a tweet the idea that there is an “abandonment of state functions regarding monetary policy.” Julio Carranza has said that “the Cuban State neither controls nor regulates the…

Read More: Juan Triana: “The instability in the exchange rate stops business and affects

2024-06-11 00:52:52